Is your project finish date realistic? Have allowances been made for late delivery of equipment, weather delays, risks? Have you allocated too much or too little contingency in your cost estimate? The Monte Carlo technique takes into consideration uncertainty and risk providing more realistic estimates of outcome and contingency allowance to match the level of risk.

Monte Carlo simulation is a computerised mathematical technique that analyses project schedules and cost estimates taking into account uncertainty and discrete risk. Uncertainty is an estimate of likely extremes of a duration estimate. If you were to estimate by saying ‘It will take me an hour to drive to work plus or minus 10 minutes’ then your best case estimate is 50 minutes, your worst case estimate is 70 minutes and your deterministic (usually your most likely) estimate is 60 minutes. Discrete risk represents a possible risk event and has characteristics of probability and consequence. You may say ‘The probability of there being snow tomorrow is 30% and if it snows, I will be delayed by 20 minutes’. Discrete risks are normally detailed on the project risk register.

Monte Carlo simulation is a computerised mathematical technique that analyses project schedules and cost estimates taking into account uncertainty and discrete risk. Uncertainty is an estimate of likely extremes of a duration estimate. If you were to estimate by saying ‘It will take me an hour to drive to work plus or minus 10 minutes’ then your best case estimate is 50 minutes, your worst case estimate is 70 minutes and your deterministic (usually your most likely) estimate is 60 minutes. Discrete risk represents a possible risk event and has characteristics of probability and consequence. You may say ‘The probability of there being snow tomorrow is 30% and if it snows, I will be delayed by 20 minutes’. Discrete risks are normally detailed on the project risk register.

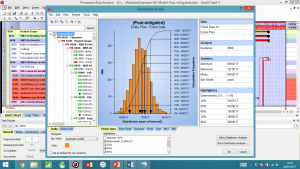

When the model is run, each element of the model varies within the uncertainty and discrete risk figures that have been set and outcomes of thousands of possible scenarios are recorded. Results are normally represented by a probability ‘S curve’ from which probability percentiles can be determined. As an example, a cost P70 means that, based on uncertainty and risk applied to the model, there is a 70% probability of completing the project within the P70 figure (and therefore a 30% probability of exceeding it)